Zero-Based Budgeting Guide-Create Your First Financial Template

Learn how to create a comprehensive zero-based budget with our step-by-step template guide.Making the right choices with your money-manageing your money-involves knowing how to Budget..

2500 Words Yes - Test 11 Minutes, 21 Seconds

2024-10-30 16:42 -0400

Personal Finance – A Budget Template

Personal Finance Series – How to establish your first zero-based budget

TLDR:

Zero-based budgeting allocates every dollar of income to specific expenses or savings categories.

- Choosing the right budgeting tool is important, consider factors like price, time commitment, bank integration, and customization.

- A comprehensive budget template should include categories for income, monthly expenses, yearly expenses, savings, giving, fun money, and debt.

- The article provides detailed guidance on what to include in each category and how to determine planned values.

- If expenses exceed income, adjustments are necessary. If there’s money left over, it should be allocated strategically, starting with an emergency fund, then debt repayment, and finally long-term savings and investments.

- Budgeting is an ongoing process that helps achieve financial control and awareness.

Zero Based Budget – Why Zero Based and Tool Selection

Jumping right in: In a traditional budget you would list your income and all your expenses by category, and essentially aim to balance your earning with your spending while leaving some amount left for a general savings. With a zero based budget you ensure to allocate every dollar of income to specific expenses or savings category until you’ve used every dollar of your earnings. Why does this differentiation matter? A traditional budget doesn’t drive down into the details, and therefore doesn’t provide the insight for financial control and awareness needed to be effective in optimizing your spending and savings. In our own journey and now working with clients, we work with zero-based budgets to get folks on track.

The next step to consider is what tool are you utilizing to budget? You can keep it simple and choose something like the pen and paper or envelope method. While these are quick and simple to start, they do take quite some patience to maintain and stay on top of. The next option are zero-based budgetting apps. There are plenty of options out there for this, some we’ve personally used include YNAB (You Need a Budget), Dave Ramsey’s Every Dollar, and our own app Peaceful Mindful Pocket.

Here’s what we recommend considering when picking the tool for you.

Tool Selection Considerations:

1. Price point

YNAB shares that “On average, new YNABers save $600 their first two months, and more than $6000 their first year.”

So while it may seem daunting to spend the average ~$100-$150/year on a budgetting app, do consider the value it is providing in the savings potential (not to mention emotional relief).

2. Time

We recommend reviewing your budget weekly. How much time you spend to do that can depend on the tool your utilizing. With most budget apps, there’s very minimal automation happening in allocating your transactions. Your transactions are pulled from your bank, and then you have to spend the time allocating each one to your selected bucket. We’ve found that it initially took us about 30 min – 1 hour once a week to review all our transactions.

As we build our app, it’s been important for us to be able to provide you with the ability to set automation rules to your transactions, making it quick and easy to get through your allocations and review your budget.

3. Bank/Card Integration

Make sure the app you’re utilizing can integrate with your bank and card providers. Apps like Every Dollar are a watchout here, as it doesn’t integrate with credit cards (Dave Ramsey’s principle is no credit cards).

The other thing most people don’t consider too much, is HOW are these apps integrating with your bank (i.e. what’s the security risk). Many apps are using services like Stripe or Plaid in their backend to make that connection to your bank. We’re not saying this is bad or good, but we do recommend you to review/understand what this means if data security is a priority concern for you.

We can share that with our app, Peaceful Mindful Pocket, while we will have bank integrations for the users seeking convenience, we also plan to provide users the ability to transfer data via CSV files so that you are not dependent upon a middle man.

4. Customization

Most apps allow some level of customization in your budget, but do limit you to one budget template. This one is highly personal preference, we just recommend that if there is a free trial period to take advantage of apps you’re interested in, and play around with the tool to see if it works for you.

Building Your Budget Template – What Should Actually Be Considered When Setting a Budget?

OK, you’re convinced about the benefits of budgetting, and you know what tool you’re using to do it. Where do you go from there, how do you actually start a budget?

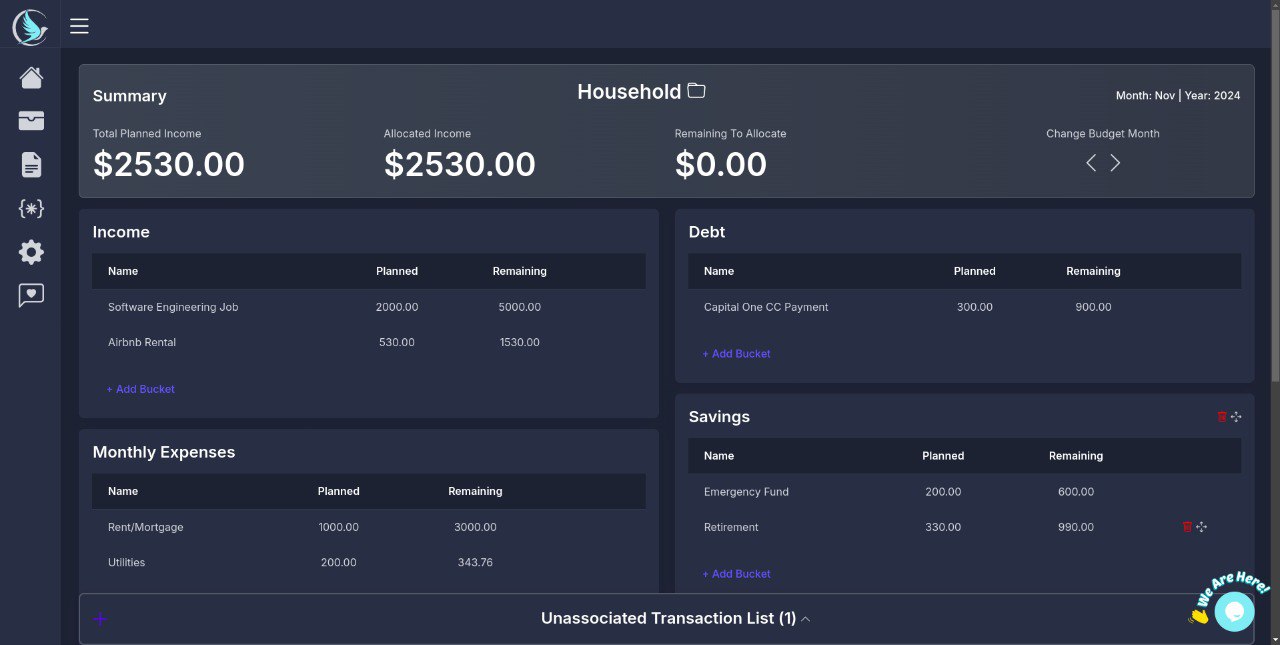

To get you a mental picture, this is how a budget template breaks down: Income, Expenses by Category, Buckets within those Categories, followed by the expenses themselves. Each bucket has a “Planned” value you assign (how much you plan to spend), and a “Remaining” value that adjusts as you process/allocate transactions (how much is left of your planned spending after your spending). Here is an image of this breakdown to help you visualize:

Below is a detailed template breakdown with our thought process behind it so that you can make your personal adjustments as needed. Use the below as a way to check off all the buckets you want to capture in your budget, or as a guide to organize your categories and buckets.

We recommend that when you’re establishing your template, you look through your last few months of bank statements to make sure you’ve captured all your expenses, along with being able to grab the values to enter into your “planned” amount.

Category: Income

Is your paycheck weekly, bi-weekly, or monthly? Do you have multiple streams of income? Set up a bucket for each paycheck or stream of income.

- Primary Income, or Paycheck 1, Paycheck 2 etc.

Category: Monthly Expenses

This is where people often miss some expenses or aren’t sure how to organize things best. Below is a comprehensive list of monthly expenses.

The big question we also get asked here is “How much should I assign to my planned expenses?” This is highly personal to your situation – our best recommendation is to use your last few months of bank statements and put down what you’ve actually been spending. Use your bank statements to also make sure you’ve captured all of your active subscriptions. Our key advice: Don’t worry yet about optimizing your spending, the first step is to focus on capturing all the information of your true spend, so you know what you have to work with. This tells you the ugly truth of where all you’re money’s been going. Once you’ve swallowed that pill, then you can take a look at area’s you and your family feel that you can make improvements on - check out my article Behaviour in Personal Finance.

Monthly Expense Buckets:

-

Rent/Mortgage

-

Water

-

Electric

-

Home Gas

-

HOA or other neighborhood fees

-

Internet

-

Phone bill (if paid monthly)

-

Car Gas

-

Groceries

-

Eat Out

-

Hygiene / Toiletries (soap, toothpaste, toilet paper, paper towels, diapers, etc.)

-

Any private/additional Insurance (private insurance, life/disability)

-

Car Insurance (if monthly)

-

Monthly Subscriptions (Netflix, Hulu, Youtube Premium, Massage Envy, Newsletters)

-

Hobbies and extracurricular activities

Category: Yearly Expenses

Take your yearly expense and divide it by 12 for your monthly planned value. If you’re starting your budget mid-year remember to adjust for the actual amount of months remaining till your due date, and then make the final correction back to divided by 12 once your renewal comes up.

Yearly Expense Buckets:

-

Credit card fees

-

Yearly Subscriptions (budget apps, hulu/netflix)

-

Admin fees (think of things like investment or retirement accounts)

-

Phone bills (if yearly)

-

Car tax

-

Property tax

-

Insurance (if paid yearly/semi-annually)

Category: Savings

Break down your savings goals into monthly planned values. Again divide by 12 for a yearly savings goal. Keep in mind you do not have to have all of these buckets - instead consider what is important to your family, and whether these items are something you already end up spending money on. The goal is that you should not have things like christmas gifts be a sudden hit in your budget - instead you should be building a savings throughout the year so that when something like the holidays approach, or your car tire blows, you’ve already got things in place.

Savings Buckets:

-

Emergency fund - Should be $1000 to start. If not dealing with any debt, then should grow to 3-6 months of your necessary expenses to cover an emergency. If you havn’t checked it out - see my article on Emergency Funds. It should be your first step in your knowledge building of personal finances.

-

Auto maintenance - For two older vehicles and DIY’ing fixes, we found that about $250/month has covered surprise breakdowns along with keeping up with basic oil/filter changes.

-

House maintenance - Similarly we found $250/month covered random items breaking in the house while building a nice nest to eventually cover larger items (water heater, A/C, etc.)

-

Home improvement - Think of things like upgrading your sink or shower head, getting that second vaccum cleaner in a 2 story house, or investing in a crock pot. This bucket is for upgrades you would like to make around your house/property. Personally, $100/month covered most the small upgrades we wanted.

-

Project savings - Think of things like starting/running a garden, building a gazebo, starting a rock band with your kids - whatever projects you want to or are in the process of.

-

Vacation - Plan out what you want to set aside for your family vacations or getaways

-

Friend/Family Events - Similar to vacation, but think of things like birthday gifts/parties, holiday gifts/parties, etc.

Category: Giving

The common recommendation for what to set aside as donations is 10% of your income, but adjust based on your situation and emotional capacity. We started with about 3% and built our way up as we felt our situation improved. The point behind the Giving category is that you get to both freely give without concern, and also holding yourself a little accountable to helping others if your situation allows for it.

Giving Buckets:

- Church

-

Organizations/Personal Interests - think of anything from RedCross to a favorite blogger/influencer that you decide to give some money to support their cause.

-

Family/friends/people in need - keep in mind, this is not a loan situation. Think of donating to something like a GoFundMe for a friend/family member, or a homeless veteran you come across and decide to buy a meal for.

Category: Personal Allowances

- Fun Money - We’ve found that $200/month/person personally covers everything for us (note: we include eating out as a fun money vs. a monthly expense, adjust as necessary). This bucket particularly is incredibly important. Think of it as your stress relief valve - no one has a say in how you spend this money, not even your spouse. It is purely for whatever you feel you need to rest and decompress. For me personally, this was also a relief from guilt. I don’t have to feel bad about spending money on something that’s just for me, it’s literally in the plan. We found it so valuable that we even kept this bucket in our emergency fund plan (at a reduced amount of $100/month), and we recommend you plan on it too.

-

Clothing

-

Family fun - While you may have a fun money bucket for each member of the family, you may want to set something up for smaller family outings or day trips that you don’t necessarily want everyone taking out of their personal allowance for. Think of things like a day trip to your local amusement or water park, museum tours, hay rides, haunted houses, christmas wonderlands.

Category: Debt

- List all debts (student loans, credit cards, etc.) - Set your planned values to minimum payments initially. Similarly with what was mentioned for monthly expenses - once you’ve figured out what your true spending and expenses are, then you can go back and target higher debt payments. For a more detailed breakdown, check out my article on Debt Repayment Strategies.

Next Steps After Template Creation

If your “Remaining to Allocate” is a negative value:

-

First, make sure you can cover your basic expenses (rent, utilities, transportation, food).

-

Next, look for areas to adjust spending. Keep in mind the below are just idea’s/area’s we’ve seen usually be inflated due to our lack of insight into your own spending. Adjust the below based on the priorities you have for life - for example, a large clothing budget may not be as important to you as eating out or fun money.

-

Take a look at what your true spend has been in buckets like “Fun Money”, “Clothing”, “Family Fun”

-

The other big buckets are usually “Eat Out” or “Subscriptions”

-

Vacation, family fun, family events may need to take cuts or be cut completely

-

If you’re still in the red, then start to look at things like your Groceries bucket, insurance plans, cell phone, and internet bills. You may need to shop around to find better options and/or reduced coverage if absolutely necessary

-

Still prioritize getting this number to have some remaining value, as it should be a priority for you to establish a $1000 mini emergency fund

-

-

Consider working with a Financial Coach - Sometimes seeing that number be in the red is overwhelming, and you just don’t know where to start or can’t process what else is left to cut out. It’s a tough spot to be in, and having an experienced third party come in and take a look at everything can take a huge weight off your shoulders to be able to start solving problems. Both my husband and I are Financial Coaches. To help you get started, feel free to book a free consultation with me, Rima Consultation to see how I may be able to help guide your journey.

If your “Remaining to Allocate” shows green or extra money left

- First and foremost, start building that $1000 emergency fund

- Next, start debt repayment (see Debt Repayment Strategy)

- Your debt free, Congratulations!!!! Start building your 3-6 month emergency fund for true financial security

- Focus on retirement/investment strategies

Remember, this is your financial journey’s beginning. Your budget can and should be adjusted as your needs and circumstances change. With a zero-based budget principle - every bit of income you earn is put to use in a directed way that best serves you.

97% of zero-based budgeters reporting feeling more in control of their money (Ramsey Solutions survey).

When you have the knowledge and insight of how your money is being spent, any additional income that comes your way will immediately go towards your goals instead of being sucked down the trap of lifestyle inflation.

We hope this article was valuable to you! Feel free to comment any questions or issues you have in the process so that we can help!